Categories

The next nuclear renaissance may be upon us, but with it comes a perfect storm. The industry is unprepared for a surge in demand for goods and services from both the existing light water fleet and the next generation of reactors. We are currently teetering on the edge of severe supply chain issues, but if the nuclear industry can understand the sources of our challenges, we can mitigate them.

One challenge is the all-time low number of qualified parts and component suppliers. This has been a slow-moving crisis during the past 20 years, as nuclear plant closures and perceived headwinds have driven OEM (original equipment manufacturer) suppliers from the nuclear market.

Second is that nuclear plant planning and procurement processes have become outdated. This has led to problems like inaccurate lead times, as Lewis Dawson, director of supply chain management for Dominion Energy, corroborates: “We have found lead times for some items to be significantly understated, especially for engineered equipment or highly manufactured components.” Nuclear operators need to utilize innovative techniques to improve demand forecasting for routine parts, the capital funding process, and scheduling for large projects.

The nuclear industry has proven its resourcefulness and adaptability time and time again. With proper planning and innovation, this time will be no different.

Current challenges

The lack of qualified suppliers—Over the past few decades, nuclear development slowed due to high cost, low demand, and negative public perception. As demand levels plummeted, the significant administrative requirements of supporting a nuclear quality assurance program became untenable for many suppliers from a cost perspective.

In addition, nuclear plants had a reputation for being irksome customers. Improper short-term planning sometimes resulted in plants buying too little and then realizing that they needed something immediately. Suppliers struggled to meet those expedited needs.

Thus, many suppliers chose to leave the industry and shut down their nuclear programs.

Today, there are fewer nuclear-approved suppliers than ever before. The industry has had to adapt and use third-party suppliers or limited internal resources to perform functions critical to maintaining operations, such as commercial-grade dedication, qualification of alternative replacements, utility-to-utility transfers, repair, and reverse engineering.

It is difficult and takes a painstakingly long time to bring large industrial and commercial suppliers into the industry today. Most don’t understand nuclear and lack the motivation to learn more, because the current nuclear market is small. Other potentially qualified suppliers aren’t interested in nuclear power due to perceived risk or past experiences. For example, an industrial HVAC supplier may consider building hundreds of HVAC systems for data centers to be more advantageous than a few system upgrades at a nuclear plant.

Outdated work management/planning processes—“In many cases, current outage milestones for requesting material are essentially based on the supply chain realities of several decades ago,” said Marc Tannenbaum, principal technical executive at the Electric Power Research Institute. “Today’s supply chain is vastly different, so perhaps it’s time to take a look at updating planning milestones based on current supply chain realities and considering other avenues to enhance availability of needed items and services.”

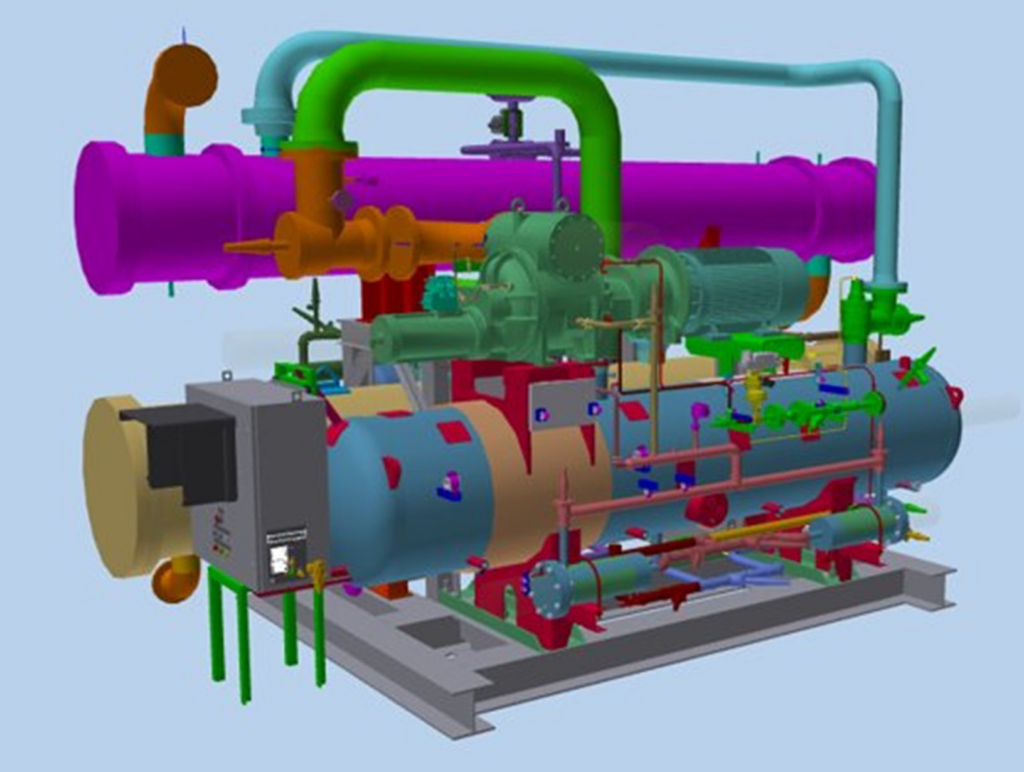

Digital upgrades for safety systems like the HIPS (highly integrated protection system) platform will be needed to extend the life of the current LWR fleet. (Photo: Paragon)

As the industry changes and demand to support nuclear new-build projects increases, both suppliers and operators must evolve the way they plan work, manage materials, and execute projects. This will need to happen on shorter timelines for day-to-day parts and on longer timelines for major components.

For work performed on-site, such as on line and refueling work, supply chain problems are driven by a lack of accurate supplier lead times and other information gaps. With ballooning lead times, parts don’t arrive until after the scheduled work. In addition, parts that do arrive don’t always pass receiving inspection, bench testing, or parts quality testing, further delaying work.

Another hurdle is obsolescence. Typically, a nuclear plant will only find out that a part is obsolete once they try to purchase it.

For larger-scale work that occurs over a longer timeline, challenges are driven by a lack of integration between the utility and supplier community. Often, the best supplier for the category is not an option because they no longer have or never had a nuclear QA program.

These days, there is also more competition for the same equipment. For plants to run for 80 years and to bring next-generation reactors to market, major equipment purchases must be made—safety-regulated digital systems, HVAC, valves, heat exchangers, and pumps, for example. This same equipment is also ordered to support data centers, oil field electrification projects, integrated circuit manufacturing, and other industries. Planning in the nuclear industry is painstakingly slow, while these other industries move at breakneck speed.

Solutions

Nuclear suppliers—Interest in nuclear power is growing; now is the time to capitalize and reenergize the field. The industry can take advantage of this groundswell of new attention to attract suppliers to the market.

For large Fortune 500 industrial suppliers with discontinued nuclear QA programs, nuclear has been exclusively off any growth opportunity radar. Recently, however, a number of these companies have acknowledged nuclear as an economic opportunity and a way to be involved in the clean energy movement.

The industry must focus on locating and attracting those interested suppliers, tying them to applicable projects, and utilizing them to sustain and maintain equipment needs.

As Nuclear Energy Institute president and chief executive officer Maria Korsnick stated, “It’s critical that companies throughout the nuclear supply chain see the opportunity in this growing market and believe in this opportunity. We need companies to prepare today for the manufacturing capabilities needed to meet this demand. We cannot wait for four or five years.”

Qualified vendors can extend a utility’s supplier base and provide quality oversight, project management, qualification, and engineering.

Finally, rules set down in 10 CFR 50.69 by the Nuclear Regulatory Commission provide a process with which to categorize and reduce quality requirements for certain low-risk existing plant equipment. This gives nuclear plants more options, as it allows a supplier to provide the best solution.

Work management/planning processes—“As recognized by recent [Institute of Nuclear Power Operations] surveys and industry discussions, part availability is a high risk to predictable and sustainable operations and plant performance, which many times requires operating differently in the new reality of longer lead times and shrinking supply base,” noted George Shampy, senior supply chain manager at Entergy.

As for outdated planning processes, it is crucial to “inspect what we expect.” We cannot rely on historical or quoted lead times for parts and components. Change happens fast, and in a matter of weeks, lead time can increase by months or even years.

Innovative tools will best improve planning for short- and medium-term work. The industry must use new technologies like artificial intelligence to assist in better management of data, workflow, and supply chain.

Paragon’s firsthand experience of how lead times impact work led to the creation of PeAks+ AI, a tool that provides an early warning alert for lead-time risk. It uses industry and plant data to provide the supplier and the plant with better forecasting, which in turn enables better preparation and management.

Such tools are useful in many different scenarios. PeAks+ AI can assist in determining alternate solutions, such as repair and reverse engineering; can alert plants to issues of part obsolescence; and can flag parts for parts quality testing.

Innovative research is also underway at EPRI to develop an AI-based model to predict spare- and replacement-part needs for operating nuclear facilities with higher accuracy than current methods. EPRI’s cutting-edge AI tools are being designed to consider data collected over decades of operation to provide a better picture of actual demand. This in turn allows development of optimized reorder strategies that enable nuclear facilities and suppliers to begin supporting spare and replacement item needs further in advance.

Of course, for these tools to be accurate, they first require data. According to Shampy, “For AI and demand forecasting to be effective, data across the industry from suppliers and utility customers must be shared and available.”

With data sharing comes security concerns. Before the nuclear industry incorporates any AI product or service into industry work, it must first meet stringent cyber and security requirements.

No matter the challenges facing the nuclear industry, innovative tools that inspire communication and collaboration have always kept us moving forward. These innovative tools, paired with advanced planning and procurement processes, will position the operating fleet to successfully address current and long-term supply chain challenges.

Nuclear operators and suppliers are resilient, having survived major upheavals over the past 30 years. Strong demand is the kind of “problem” we all welcome, but the industry must answer the call and operate the fleet safely, reliably, and economically. It is also imperative that we bring next-generation reactors to fruition. We will only accomplish this by solidifying the existing supply base, improving procurement processes, and bringing important commercial suppliers to nuclear.

With focused preparation, the sky is the limit for the nuclear industry. As NEI’s Korsnick noted, “That sense of possibility and excitement is palpable in nuclear right now.” Let’s capitalize on this time of exciting change.

This article is by Doug VanTassell, chief executive officer of Paragon Energy Solutions, and appeared in the August 2024 issue of Nuclear News.